Why Solo-Mining Bitcoin Is Worth Talking About - Heading into 2026

I’ll be straight with you: I started fiddling with mining because it felt like a real-world “lottery ticket”, but one where you could at least learn the rules, tweak the odds a little, and sleep at night knowing the network you’re helping secure is actually useful. Bitcoin isn’t a fad anymore; it’s the original, battle-tested proof-of-work network that’s been running for over a decade. That history matters. It means the coin you’re trying to solo mine has market depth and liquidity that most alt-coins simply don’t.

The odds are tiny, but that’s the point

To be blunt, your chance as a hobbyist to hit a block on your own is minuscule compared with industrial miners. A single modest ASIC represents a microscopic share of total network hashrate. But tiny odds don’t mean “zero.” Every now and then a small-scale miner wins the full block reward. It happens, and when it does it’s a big payday (and a great story). With a purely decentralised currency, the best way to keep it like that is to provide every household with the equal opportunity to support the Bitcoin blockchain through mining. When one person holds too much of the mining share (i.e large private mining companies) the pure nature of “decentralised transactions” becomes a real threat.

A changing industry - more “room” for solo miners?

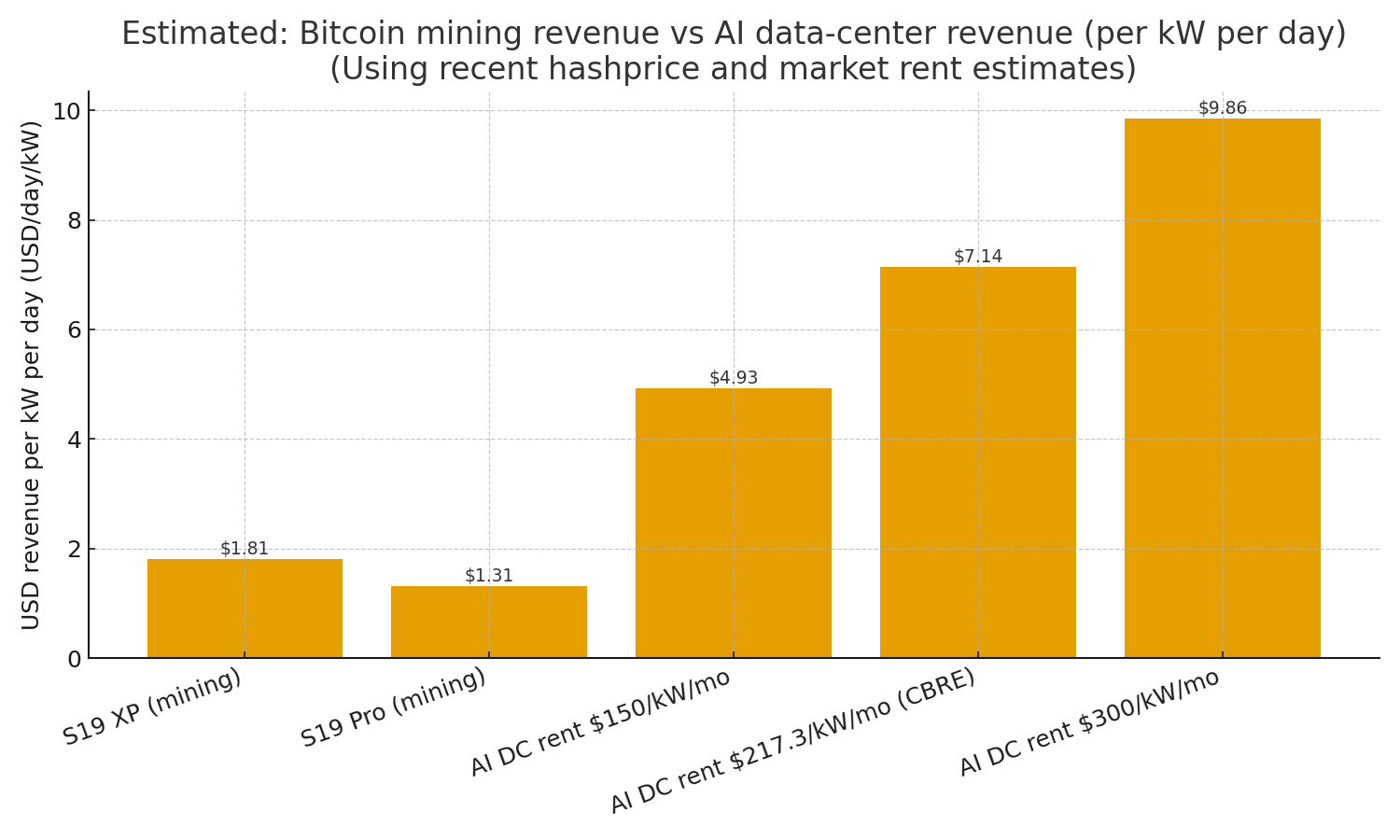

Recently, there’s been a wave of major industrial mining operations stepping back from pure Bitcoin mining and pivoting toward AI data-centers or high-performance computing.

For instance, one large public miner announced it will completely wind down Bitcoin mining by 2027, converting existing facilities into GPU-based AI infrastructure.

Others are still mining Bitcoin, but increasingly see mining as only one piece of a broader strategy. Some report big drops in BTC output since the 2024 halving and are expanding into GPU-as-a-Service operations.

The shift reflects that mining profitability has tightened (post-halving block reward shrinkage, higher energy costs, growing network hashrate) and many large players believe AI/HPC workloads will offer steadier returns.

What this potentially means for solo miners: less competition from large-scale miners over time, or at least slower growth in aggregate hashpower — in theory improving your (already slim) odds of finding a block if you stick it out long-term.

Important caveats (please read)

These are estimates to illustrate relative economics, not a full profitability model. I used publicly reported snapshots (hashprice and rent figures) and manufacturer specs; you should treat the chart as directional.

For mining, the chart shows revenue at current network prices (pre-electricity and other costs). To judge profitability you must subtract electricity ($/kWh), cooling, hosting, fees, and amortize hardware cost.

For AI data centers, “revenue per kW” is rent charged to tenants — the operator’s margin depends on utilization, financing, depreciation, power contracts, and customer mix. Reports show AI tenants can and do pay premiums for dense, liquid-cooled racks.

This chart was generated with the assistance of ChatGPT.

Why I prefer Bitcoin (for solo attempts) over unstable alt-coins

Alt-coins can spike dramatically, and sure, early solo mining of a new coin can reward early adopters. But most alt-coins die, get rug-pulled, or simply see liquidity vanish — leaving miners with coins no one can sell. Bitcoin’s market depth and long track record make any reward you do find far easier to realize in cash (or HODL). If your goal is a low-probability, high-value win that you can actually convert to fiat, Bitcoin is the safer bet compared to the wild-west of dozens of tiny, unstable coins.

I’ve provided a calculator on my website that can be used to help understand block mining odds when it comes to Bitcoin.

Practical advice from someone who’s been there

Treat solo mining as a long-term speculative play, not a side hustle that’ll pay your power bill next month.

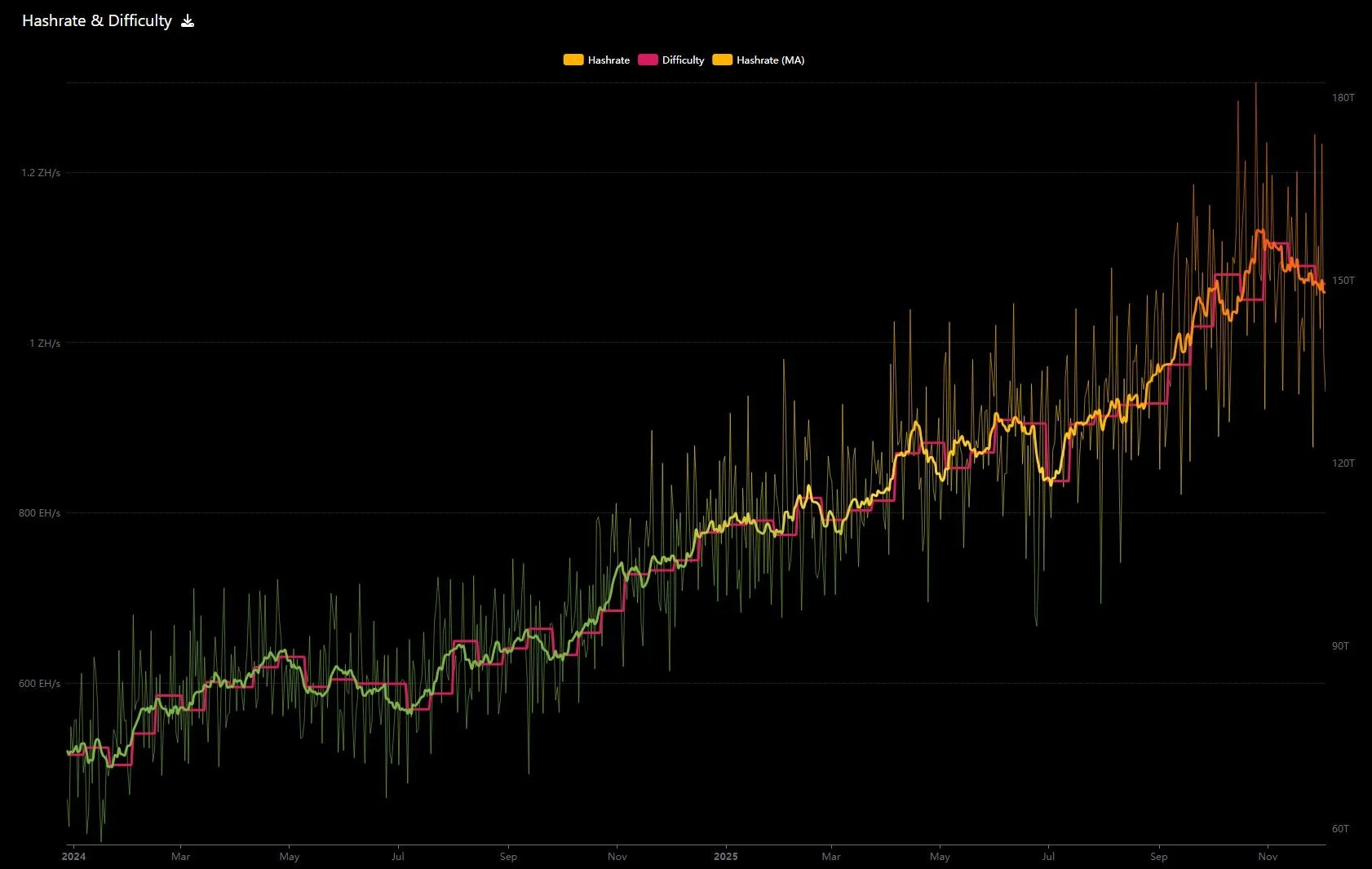

Track difficulty, hashrate, and price charts regularly — they tell you when you’re being crushed by scale and when the landscape briefly favors smaller players. Good sources: public charts, mining-economics trackers, on-chain analytics.

If you want exposure to the potential upside but a steadier stream of smaller payouts, consider hybrid strategies (solo-via-solo-pools that pay when you find a block, or mining pools with low fees). Know each option’s tradeoffs around rewards, variance, and autonomy.

Factor in real costs: electricity, cooling, hardware depreciation, and time. A lucky block is awesome — but it shouldn’t be the only plan that keeps you solvent.

When a solo win makes sense

You might reasonably try solo mining if:

You have access to very cheap, reliable electricity or subsidized power (your personal home solar/battery set up means you have almost zero risk).

You enjoy the operational side (running and maintaining hardware, monitoring nodes).

You accept long dry spells and are prepared mentally and financially for the variance.

Otherwise, pooled mining or cloud/mining-stock exposure might be a better route.

Do your own research

This isn’t financial advice — do your own homework. Look at historical hashrate, difficulty charts and mining economics over time; read stories from other solo- or small-scale miners (they remain rare but real); and calculate your break-even under realistic assumptions (hardware cost, expected lifetime, electricity price, cooling, and fees).

Final, personal thought

I still like the romance of solo mining. There’s something primal about running a machine that competes on the decentralised network and ‘once in a great while’ wins a whole block. And, in light of recent industry shifts away from large-scale mining, a solo win feels a bit more meaningful. If you do it, go in with clear eyes: understand the math, watch how the industry evolves, and always remember Bitcoin’s market resilience makes a solo win much more meaningful than finding a random, illiquid alt-coin block. If you’re in for the long haul and you enjoy the technical/hands-on side, it can be one of the most genuinely fun ways to participate in crypto.